January isn’t just the start of a new calendar year—it’s a time to transform year-end successes into strategies that fuel long-term impact.

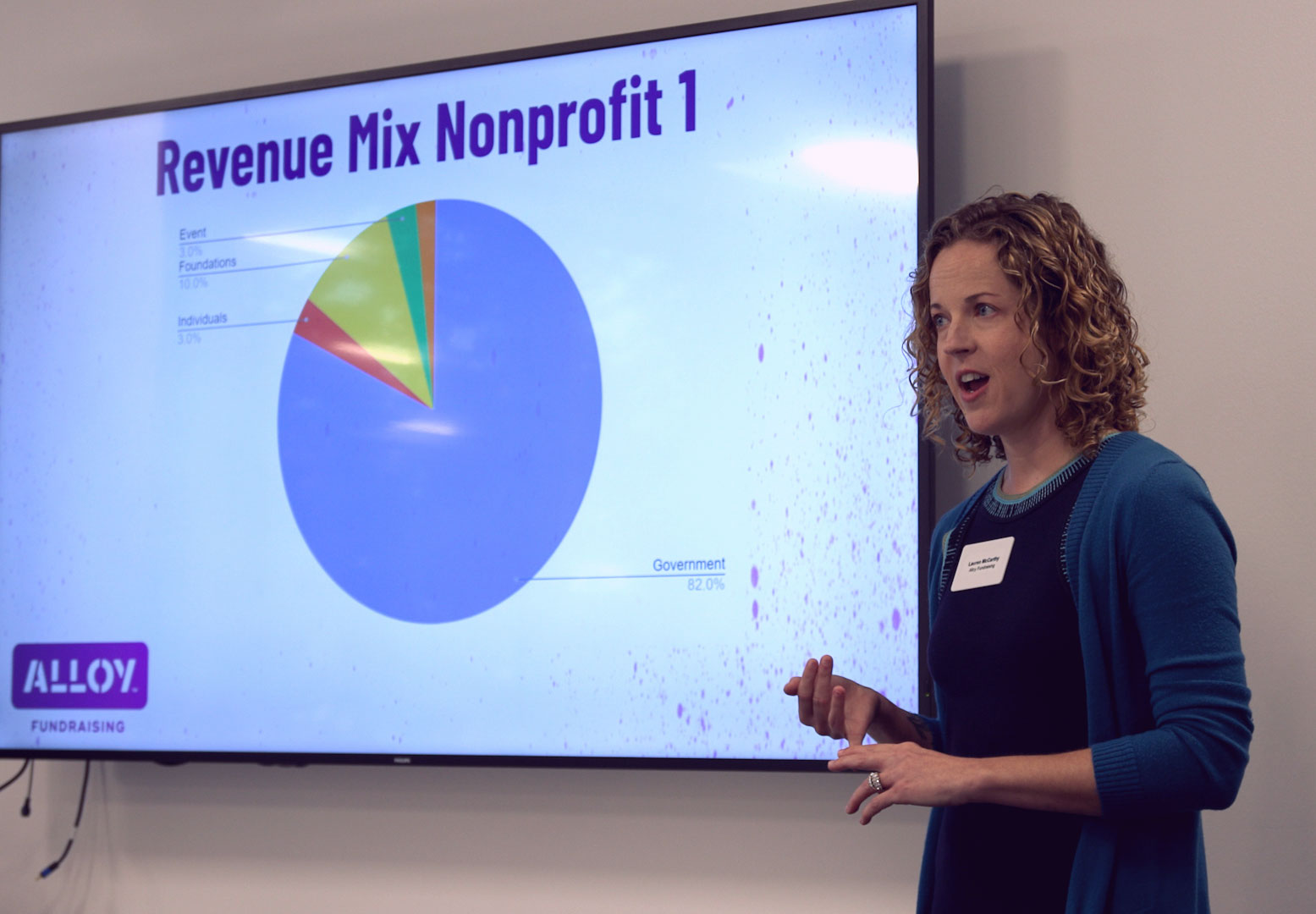

Last month, Alloy Fundraising partnered with Marshall Jones CPA firm for a Lunch & Learn on the Road Map to Diversification of Revenue. Accountants, nonprofit professionals, and community stakeholders discussed how to prioritize planning and community relationships for a strong revenue mix.

A nonprofit's revenue mix—the various sources of funding it relies on—plays a significant role in its ability to grow, adapt, and fulfill its mission by making a lasting impact. Whether you're leading a nonprofit or managing its fundraising, understanding and tracking your organization's revenue mix is essential.

Revenue mix refers to the combination of varying philanthropic and income streams. According to Giving USA, individuals (67%) give the most philanthropic dollars with foundations (19%) coming in second followed by bequest and corporations. Other streams of revenue could include government and private grants, earned and endowment income.

So what does an ideal revenue mix look like? It can vary based on an organization’s mission area, location, etc., but one example is 60-70% from individuals, 10-15% from corporate or government, earned 5-10% from revenue and 2-5% from private grants. This is an ideal revenue mix and often not the reality. Still, if your organization is too reliant in one funding area and scarce in another, take these steps to right-size revenue mix.

Know your mix

Are you heavy in one or two areas? Do you have a plan if these revenue sources change, increase or are no longer available?

Protip: Your finance and development teams as well as your CEO and board should be aware of your mix, areas for growth and weakness. You all should talk about this regularly.

Understand your budget and revenue mix: There is a difference between having a balanced budget and cash flow. There are some contracts or reimbursements that can take anywhere from 30-90 days to receive the cash.

Protip: You can have a balanced budget and at the same time not have cash in the bank. This is why managing both is important.

Manage and track your sources: How has it changed over time and why? Do you know of other impending changes both increases and decreases?

Protip: Ask questions and really listen to your funders’ answers. Many times they will tell you what funding to expect for the future. And if the funder tells you they may stop funding in 4-5 years, start planning NOW.

Set goals and make a plan for how you are going to adjust your revenue mix.

Protip: Good and bad surprises happen! You could receive transformational bequests, a surprise gift from Mequenze Scott, or a foundation could be a spend down foundation or close. Prepared and have a plan for how this information or surprise will affect your long term sustainability.

No matter the revenue source, relationships are at the heart of a sustainable and diversified revenue mix. These relationships can help you predict when a funding source is going to increase or decrease, when a funding priority might change or even how a party change in the government might affect your grants.

Your board members, committee members, staff, stakeholders and volunteers are your tentacles into the community. They are your best asset to share the impact of your work, help secure dollars, influence their networks and have their ear to the ground. Bring them in, partner with them and pay attention to your funders.

A diverse revenue mix doesn’t just ensure financial stability; it allows nonprofits to continue fulfilling their mission, expanding their impact, and securing long-term sustainability. Those with intentional relationships who can adapt, track, and diversify their revenue sources will be best positioned for sustainability.

Burning questions? Reach us at [email protected]

January isn’t just the start of a new calendar year—it’s a time to transform year-end successes into strategies that fuel long-term impact.

Last month, Alloy Fundraising partnered with Marshall Jones CPA firm for a Lunch & Learn on the Road Map to Diversification of Revenue.